About Kabbage

As a small business owner, it can sometimes be difficult to generate the capital in order to launch or support your business venture. Yes of course you can use your own savings and go to the bank for a loan, but after all it is the 21st century so there have to be other more revolutionary ways to get the finances you need to help launch your company. One such company that is helping to lead the way in small business loans is Kabbage.com. Kabbage delivers small businesses financing. Both ecommerce and brick-and-mortar small businesses turn to Kabbage when they need fast cash advances.

Kabbage is a top online provider of working capital to small businesses. Kabbage has built the world’s fastest platform to provide capital to small businesses, funding companies within 7 minutes. Kabbage leverages data generated by dozens of business operations to understand performance and deliver fast, flexible funding in real time. Data sources include:

- EBay

- Amazon

- UPS

- PayPal

- Shipping analytics

- And many others

Founded in 2009, headquartered in Atlanta, Georgia, with a marketing office in San Francisco, California, Kabbage is now the best choice for online small business loans. Get the money you need to grow your store today. Kabbage makes getting funding simple. Let’s delve deeper into some of the key features of using this revolutionary and forward-thinking service.

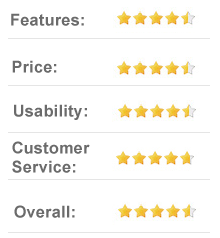

Top Features Of Kabbage

In short, Kabbage provides working capital in the form of a cash advance to online merchants who list products for sale through online marketplaces. With the help of their patents, Kabbage analyzes a variety of metrics including the merchant’s selling history, customer ratings, income and credit history, UPS shipping data, and Social Media to give them a Kabbage Score, then those who apply are eligible to receive an advance from Kabbage ranging between $500 and $100,000.

Kabbage is not like your typical lender because they are looking to help small businesses get the capital they need to fund their opportunities and grow their business. They can loan in larger amount because they are looking at your business revenue not your paycheck.

An example of how one might use this funding is if there is a business opportunity available and you need cash quickly, so you can buy goods at a lower cost and then sell them for a higher amount using the profit to pay back the loan. It makes sense if the perfect situation comes along, so it just a matter of recognizing those opportunities. It’s also a matter of showing the representatives at Kabbage that you have the money coming in.

Small business loans are not the easiest thing to get, so it’s nice to see a service that is starting to fill this void in the marketplace. If you’ve been turned down for a loan by a bank before, you will probably recognize that there is a need for funding to businesses that don’t necessarily follow a traditional format. Many banks don’t understand how online businesses work, and are looking for businesses that are following older practices.

According to the Kabbage website, they are basically trying to be the better alternatives to going through a bank. Kabbage tries to draw a lot of contrast to banks, and they say that they understand small businesses better, and respect them more. What makes them unique is that they are able to see your money coming in using less traditional ways, as long as you can prove you’ve got money on the way. They are also willing to work with small businesses that are not already established. This is especially beneficial to those small businesses that are having trouble getting a bank loan since a bank would just automatically reject that business for not falling within the boundaries of the kind of business they want to deal with.

Kabbage Prices

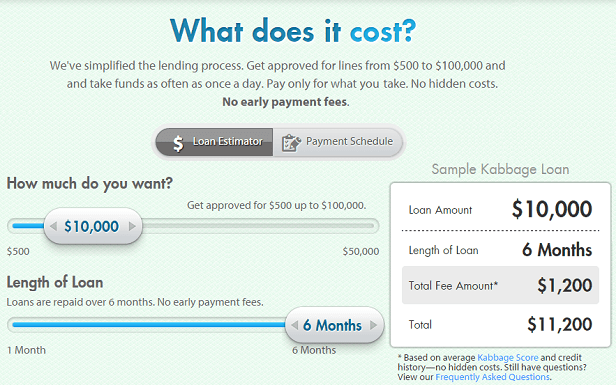

As mentioned previously, upon applying for a loan you are able to receive a loan between $500 and $100,000. Fees are 1% – 13.5% of your selected loan amount the first 2 months and 1% for each of the remaining 4 months. The nice thing is that there are no early payment fees, so you do not have to put down a large amount of cash up front.

Then every month, for six months, you will have to pay back 1/6th of the total loan amount plus the monthly fee. You also have the option to pay early and save. Each draw is treated as an agreement between you and Kabbage. You can draw against your line as often as once a day and you only have to pay for what you take.

Criticism Of Kabbage

There are many beneficial and positive attributes to using Kabbage, but there are also quite a few drawbacks that current and previous users warn against. The services can definitely benefit business owners who need a little working capital to get through lean periods or buy additional inventory. But inevitably if you run into trouble paying, Kabbage is relentless in accessing, and in some cases completely wiping out all of your accounts to get the loan repaid. And there is no way for borrowers to unlink accounts to which they have provide Kabbage access.

Another huge issue with Kabbage is lack of info. You get a statement with your minimum monthly payment around the 5th-7th of the month and then have less than 3 weeks to pay it. You really need to stay on top of the statements that you receive or else you will find yourself behind.

Customer Support

It’s not overly difficult to get in touch with representatives at Kabbage. Users are able to get in touch directly with the company through phone, e-mail and live chat. All contact can be generated directly through the website and response times are generally very good, with phone calls and e-mails returned within a maximum of 24 hours. Live chat is immediate and there is usually a team answering the live chat every day of the week.

There are also financial experts employed by Kabbage who are on hand to help you make decisions and discuss with you the status of your loan application. This is all very important and should give all users peace of mind knowing that the folks at Kabbage are willing to work with you to make the loan process work. Ultimately the site wants your business to succeed and the customer support is a step in the right direction!

Final Thoughts

Kabbage is a wonderful new opportunity and way to get additional funds if you are a small business that needs a bit of startup capital to grow the business and capitalize on an opportunity. If you are just getting started and are in need of some cash flow in order to prime the pump to get the revenue rolling in, it just makes sense to get the money you need and get it in a format that lets you put it to use straight away, so you don’t have to wait around.

The process is quite simple and much easier to work with than going through a bank. However, just make sure you are on top of when interest payments are due since otherwise you could end up in some hot water. Otherwise, if you’re a small business and need some capital to get your business off its feet, check out Kabbage.com today and schedule a free quote. Your future could really be riding on the services of Kabbage!