About Perfect Money

Perfect Money seeks to bring Internet transactions to a whole new level. Perfect Money was founded by a group of experts in economics, law, banking, and a team of programmers with a dynamic understanding of the e-finance industry. Perfect Money, after analyzing how humans have handled money through the ages, came up with a payment tool that works all over the planet.

The approaches to estimating costs in the economy and the current payment systems were carefully studied by Perfect Money’s analysts. Combining the best achievements and progress of global technologists and economists, Perfect Money came up with their new payment system.

Top Features of Perfect Money

An e-currency company is only as good as their withdrawal and funding options. Without any hindrances, you can make instant transactions with Perfect Money’s payment system, which provide you with an array of withdrawal and funding options.

The withdrawal options on Perfect Money are Mastercard or Visa gift cards, Perfect Money e-vouchers or prepaid cards, certified exchange partners, other e-currencies, and bank wire.

The funding options include instant SMS deposit, debit cards, certified exchange partners, bank wire, Perfect Money e-voucher or prepaid card, other e-currencies, and cash terminals. You can also use instant bank transfers.

Before I go into detail on all of the features offered by Perfect Money, I am going to give you a quick rundown of what makes them great:

- iPhone and Android operating system apps

- Funds kept secure with the help of CodeCard Protection, identity check, domain security, and SMS authentication

- Buy EUR and USD currencies and gold online

- Send payments to various businesses online

- Detailed account report and statement

- Using the e-voucher payment option, you have the ability to create instant funding from any Perfect Money account

- Between members of Perfect Money, you can perform swift transactions

- Using Perfect Money, you can shop for services and goods online

- From various Internet businesses online, you can get payments

With any company handling your money, you need to be sure that they are secure. A scientific research group of specialists in the finance and information security industry have developed Perfect Money’s security system. Customer security is achieved by their group of engineers by using

- Technologies of artificial intelligence for customer authentication

- Online security monitoring performed by Perfect Money

- Large scale financial instrument operations experience

For identification of Perfect Money account customers, identity check is used. Identity check works by keeping close watch on what computers people use to access their accounts. The email address specified during the registration process will get notification if someone tries to access an account from a computer that is unrecognized.

To identify account owners, SMS authentication is used. A confirmation code is sent to a person’s cell phone number. They must then use the code to access their account information. SMS login systems are some of the most sophisticated ways of weeding out unauthorized access.

With CodeCard Protection, you get an email with a graphic picture of a code. To confirm a transaction, you must enter the code into the appropriate area on Perfect Money. A majority of the most prominent financial institutions across the globe use this type of protection. This stops identity thieves in their tracks.

The great thing about Perfect Money’s many security protections is that you can choose which ones you want to use to protect your account. The control is in your hands.

Perhaps my favorite feature of Perfect Money is their interest rates. Their four percent annual interest rate is unrivalled in the industry. Not only does the high rate set it apart, but also the terms make it great. If there is one month where your balance is low, no problem! The interest rate is based on your minimum balance for each month.

So, technically, you get a .33 percent interest rate compounded monthly on your lowest balance for that month. Outstanding!

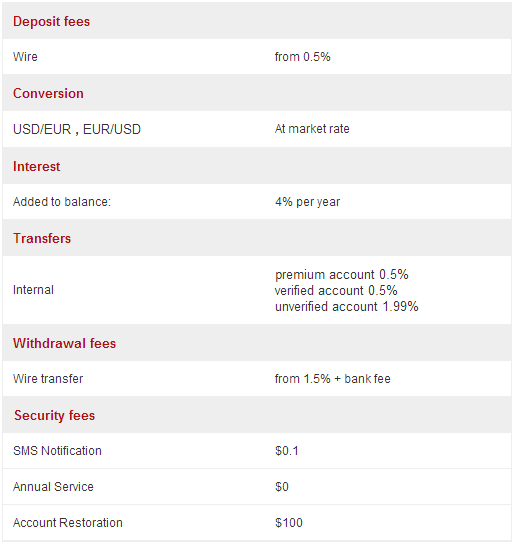

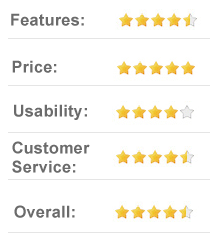

Perfect Money Prices

There are two main types of accounts you can have with Perfect Money. The Normal account is assigned to all customers when they first register. They do not have any limitations applied to their system use. With the Normal account the following apply:

- Wire deposit fees starting at one percent

- Euro to US dollar exchanges and vice versa at market rate

- Four percent interest added to balance each year

- Internal transfer has a 1.99 percent fee for unverified accounts and .5 percent for verified

- Wire transfer withdrawal fee starting at .4 percent plus bank fee

- Ten cent SMS notification fee and $100 account restoration fee

All customers who are active for at least one year can be updated to the Premium account type. You can also achieve Premium status after three months if you make a deposit of at least $50,000. There are a variety of benefits that come with a Premium account. Premium accounts get priority treatment on all withdrawals and deposits.

There is a low two percent fee on balance transfers via bank for Premium accounts. There are also a number of other goodies included in the deal, including discounts on commission fees. A request to Perfect Money’s Customer Support must be made by customers seeking to upgrade from the Normal account.

There are also business and partner plans that are beyond the scope of this review. For details on those, visit PerfectMoney.com.

Criticism of Perfect Money

There are a few minor downsides to using Perfect Money that mainly have to do with any e-currency provider. For the most part, most of the transactions are final. Though there are circumstances where you can contest a payment and get your money back. Since Perfect Money is relatively new, there are some Internet businesses that do not accept payment from them yet, but that will likely change.

To find out what others were saying about Perfect Money, I took to the message boards. A lot of people have had positive experiences using the service. There were a few people griping about the fees, but they seemed to think that Perfect Money should not charge any fees and that they should just do the work out of the kindness of their heart. This seems unrealistic to me.

Customer Support

To make sure every user is finding the individual approach he needs to solve his problems, Perfect Money provides customer service and financial management. Their qualified specialists are available 24 hours a day, seven days a week, and 365 days per year. The customer support center representatives are well-versed in online financial transactions and bank activity.

With the Support Center, users can perform any transaction, see their account balance at any time, and ask any questions.

Conclusion

There are a lot of e-currency services out there vying for your business. The key factors you need to consider is what will happen with your money as it sits there and when you make transactions. With Perfect Money, you will not find any other service that give you four percent interest as your money sits in the account. That is better than most banks.

When it comes to transaction fees, Perfect Money is comparable to other services. Tipping the scales in Perfect Money’s favor is their commitment to security and adherence to the law. Since Perfect Money is a great financial institution on all fronts, I give it my strongest recommendation. If you need to accept or pay money online, Perfect Money is the way to do it.