The growth of online shopping made it important for companies to develop reliable payment processing options that would protect people from security risks while letting them buy items from businesses all over the world. While PayPal dominates the industry, there are other payment processors that offer similar, and sometimes better, services. The only reason PayPal has such a big following is that it got started back in 1998. It took other companies a few more years to develop technology that rivaled PayPal.

Payeer.com is one of the payment processors that offers a useful alternative to PayPal. The company has founded in 2010. Today, the company has three offices. It’s headquarters is in Tbilisi, Georgia. That’s the country near Russia, not the state in the U.S. The other offices are located in Aberdeen, Scotland and Moscow, Russia.

Payeer.com offers a diverse number of affordable and free services that help merchants and shoppers protect themselves without restricting how they use money. I’ve been managing an online store for several years. When I started, we relied on PayPal. To be honest, we didn’t really like PayPal, but it was the only payment processor at the time. Now that we have more options, we’ve evaluated several companies and decided to use Payeer.com. After several years of service, I can confidently say that we are more satisfied with Payeer.com than we ever were with PayPal.

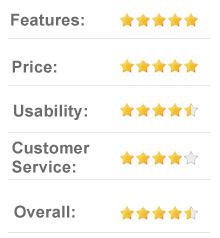

Top Features of Payeer.com

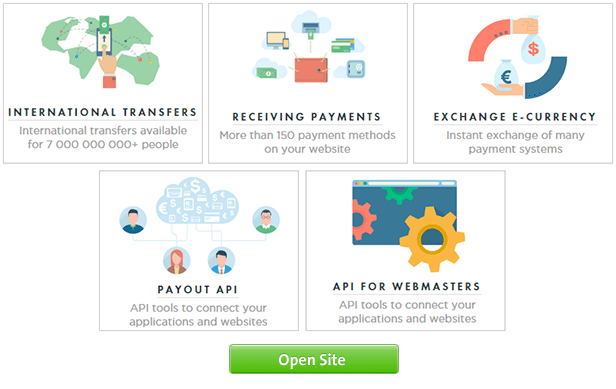

Payeer.com offers considerably more features than its competitors, including PayPal. The features that you find most helpful will depend on how you plan to use your account. After all, a business using Payeer.com to process online payments will have different needs from an individual using the service to pay for goods online.

Here are some of the most useful features offered by Payeer.com. I’ve marked the few features also offered by PayPal. I think this will make it easier for people to see how much more comprehensive Payeer.com is than PayPal.

- Send payments to any location in the world (PayPal also offers this)

- Mass payment option that makes sending money and processing payments easier

- Currency exchange services

- International SWIFT transfers

- Option to fund account via SWIFT (PayPal also offers this)

- Option to fund account with a debit or credit card (PayPal also offers this)

- No transfer limits

- Account cannot be frozen

As someone who manages a small e-commerce site, my favorite features include Payeer.com’s lack of transfer limits and mass payment option. There’s no telling how much time and money I’ve saved because of those.

Payeer.com also offers a six-tier referral system that can help you make money by getting other people to create accounts. I don’t know of any other online payment systems that do this. I’ve seen some that reward you for signing one person up, but I haven’t seen any that will pay you for the other people your referral signs up.

Of course, your payment gets a little smaller as the referrals move away from you. Still, this is an easy way to earn a little extra money without doing much, if any, work. All you have to do is spread the word about Payeer. Once people learn about the service, they will sign up. Just make sure you pass along your referral link so you can get paid.

Payeer.com Prices

Payeer.com charges different amounts for its services. To make it as simple as possible, I’m going to list some of those services and their current rates.

Sending Money Internationally: Free

Receiving International Transfers: 0.95% of the total amount

Currency Exchange: 2% of amount exchanged, regardless of currency type

Deposits: Free

Withdrawals: Between 3% and 5%

SMS Notifications: $.05 per notification

Password Recovery: Usually free. Up to $50 if you have disabled your account’s automatic password recovery.

Criticisms of Payeer.com

I really racked my brain trying to think of something I dislike about Payeer. Well, that’s not completely true. There are some things that I don’t like much, but all of the other online payment processors have similar features, so they aren’t worth mentioning. (Who likes paying fees of any sort?)

While thinking about this, I did a little hunting online to see what other people have said. I was a little surprised to see that some people criticize Payeer.com for accepting Bitcoin. Apparently they think that dealing with Bitcoin automatically means that payment processor is involved in illegal activity.

I don’t find this criticism legitimate at all. Sure, there are people who use Bitcoin and other cryptocurrencies to get around the law. That guy from Silk Road got busted in the United States. His site used Bitcoin to help people buy illegal drugs. So, yes, there are examples of people using Bitcoin to break the law. But people also use cash money to get around laws. Do the critics think we should outlaw cash, too?

From a more realistic perspective, I see Bitcoin and similar currencies as a necessity in today’s global economy. It doesn’t make a lot of sense for people to use government-sponsored currencies in a world where even average consumers buy goods from international sellers.

This criticism seems silly to me. I guess if you have some kind of moral position against Bitcoin, then you shouldn’t use Payeer.com.

Payeer.com Customer Support

The only way to contact Payeer.com’s customer support team is via email. The website has a form you can fill out. The company says it responds to all questions within 24 hours. Personally, I’ve never had a problem that required contacting Payeer.com customer support, so I can’t really comment on how effective it is. With that said, it’s obviously a good thing that I haven’t encountered any problems after three years using it.

If you ask me, avoiding problems is the best form of customer service!

FAQ About Payeer.com

Pros of Using Payeer.com

- More account service options than most online payment processors

- Generous rewards for referrals

- Ability to fund account with several types of currencies, including Bitcoin

- Offers currency exchanges as affordable rates

Cons of Using Payeer.com

- Uses Bitcoin and other cryptocurrencies (apparently some people think this is a negative feature)

Conclusion

There are so many payment processors right now that merchants and consumers often have a difficult time deciding which ones they should use. As someone who spent a lot of time researching alternatives to PayPal, I have seen the pros and cons to using dozens of these options. In my opinion, Payeer.com is the best. It has affordable rates; it accepts a huge range of currencies; and it doesn’t try to tell me what I can and cannot sell. In other words, it offers both the freedom and security that my e-commerce site needs to flourish.

Those are two things that we could all use a little more of in today’s global marketplace. In fact, I think they are what Internet technology is all about.

If you are looking for a new payment processor, I recommend looking into Payeer.com to learn more about its features. There is a good chance that you will like it just as much as I do, especially if you manage an online store that ships goods to people all over the world. It is also a great way for consumers to buy items without the hassle or limitations of most payment processors.

Once you get tired of using your current online payment system, spend a little time at Payeer.com. Having used it for a few years now, I think it is one of the best options available.