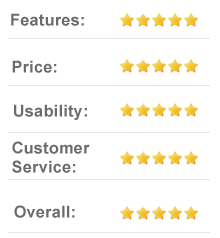

Known for its copy-trading feature, eToro is a unique trading broker with diverse investment options. Currently, it allows users to trade currencies, cryptos, stocks, commodities, and indices.

But is this social trading platform worth your time? This eToro review details the platform’s top features, commissions, costs, customer support, and more.

About eToro

eToro is a multi-asset brokerage that was established in 2007. It serves over 13 million investors in more than 140 countries, including the United States.

U.S. customers can only engage in cryptocurrency trading, while non-US citizens can trade in cryptos, CFDs, ETFs, and stocks.

eToro prides itself as a leader of the fintech revolution. It was among the first platforms to introduce the social trading feature. Users can use this feature to chat and interact as they trade.

eToro is entirely safe. Top-tier financial authorities from different countries regulate this platform. Below are some of these regulating bodies.

- USA: Regulated by FinCEN (eToro USA LLC)

- U.K.: Regulated by the Financial Conduct Authority (eToro U.K. Ltd)

- Australia: Licensed by Australian Securities and Investments Commission (eToro AUS Capital Pty Ltd)

- Cyprus: Regulated by Cyprus Securities and Exchange Commission (eToro Europe Ltd)

This trading platform supports over 18 languages. It comes as a web-based and mobile platform.

Top Features

As a multi-asset platform, eToro appeals to a range of traders. Here are some standout features

that lure investors.

Copy Trading

eToro is well-known for its easy-to-use copy-trading feature. Here, you can automatically copy top-performing traders and replicate their moves.

You trade the way such traders trade and make a profit whenever they make a profit. Of course, the traders you copy get remuneration using the platform’s Popular Investor Program.

Copy-trading at eToro is straightforward. Select an investor (up to 100) you wish to copy, then click on the copy button. Such a move allows you to mirror the investor’s position immediately.

It’s advisable to embrace the stop-loss level option to minimize the risk of losses when copy trading.

You’ll need a minimum investment of $200 to copy-trade at eToro. The maximum amount you can invest is $500,000.

eToro doesn’t charge a fee for its copy trading feature.

CopyPortfolio

CopyPortfolio is an investment fund that enables you to copy portfolios of eToro traders. eToro’s investment committee will handle all your capital if you opt for this feature. It suits traders who are seeking a passive way to invest.

CopyPortfolios don’t attract management fees or other commissions.

Multiple Order Types

eToro supports the following order types:

- Market Order – Execution happens at the current bid/ask price.

- Limit Order – Execution happens when the market reaches the set price.

- Stop Loss Order – Closes a position once the price reaches a certain level.

- Trailing Stop Loss – This feature allows you to lock up profits when the market swings.

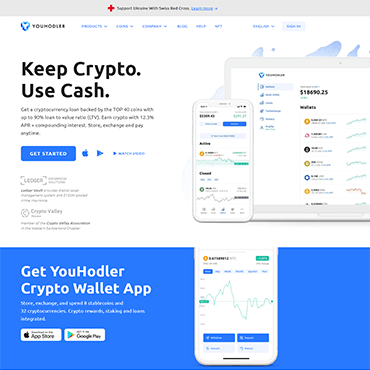

eToro Wallet

eToro has a secure digital mobile wallet that supports many cryptocurrencies. Beware, it isn’t a real crypto wallet and doesn’t store funds.

This wallet facilitates the trading and sending of funds in eToro. Traders also have the option to transfer funds from this wallet to an external wallet. However, you won’t be able to transfer digital currencies from external wallets to the eToro wallet.

eToro’s wallet is beneficial to beginner traders who handle small amounts of cryptos. Never hold vast amounts of virtual coins in this wallet.

CryptoPortfolio

CryptoPortfolio allows traders to invest in popular cryptos. For cryptocurrency to fit in this portfolio, it must have:

- A market cap of $1 billion

- An average monthly trading volume of $120 million

Some of the cryptos that frequently meet these requirements include:

- Bitcoin

- Ethereum

- Ethereum classic

- Litecoin

Plenty of Education Materials

There are plenty of educational resources on this trading platform. At the moment, you’ll find the following education sections.

News and Analysis

This section offers up-to-date news on cryptos and other traditional assets. You’ll also find in-depth discussion on markets, investments, stocks, trading, and copy trading.

Online Trading Academy

eToro has an online academy that offers learning resources to beginner and expert traders/investors. These resources come in the form of webinars, guides, podcasts, and videos.

Most of the available topics touch on stocks, cryptocurrencies, investing, trading, and eToro basics. All resources are free and don’t require you to sign up or submit your email.

Demo Account

eToro offers a trial account where traders can hone their trading skills and learn about different markets. It comes pre-loaded with $100K.

Unlike other limited demo accounts, eToro’s virtual portfolio gives you access to over 3000 trading instruments.

You can experiment using different order types, leverages, and any strategy you wish to implement.

The copy trading feature is also available on the trial account. You can learn and mimic top traders without risking your capital.

eToro Fees

The trading fee structure on eToro is slightly complicated. This is because the platform supports many trading options.

Trading Fees and Commissions

Unlike crypto exchanges, eToro doesn’t charge the standard trading fee. Instead, it imposes a “spread fee.” eToro derives this fee from the difference between the asking price and the offer price.

The spread depends on the type of cryptocurrency. Below are the current spreads for popular digital assets.

- Bitcoin – 0.75%

- Bitcoin Cash – 1.90%

- Ethereum – 1.90%

- Litecoin – 1.90%

- Ethereum Classic – 1.90%

- Ripple – 2.45%

- Cardano – 2.90%

- Dash – 2.90%

- Stellar – 2.45%

Spreads for other CFDs are as follows:

- Commodities – from 2 PIPs

- Currencies – from 1 PIP

- Stocks and ETFs – 0.09%

- Indices – 0.75 points

eToro also charges overnight fees for trading positions that roll over to the next day. At the time of writing, the roll-over fee for Bitcoin was 4.377224.

Non-Trading Fees

eToro charges the following non-trading fees.

Inactivity Fee

eToro charges a $10 monthly inactivity fee for traders who fail to log in to their accounts for more than a year. You can avoid this fee by logging into your account at least once every twelve months.

Withdrawal Fee

All fiat withdrawals from eToro attract a cash-out fee of $5.

Conversion Fees

eToro supports only USD transactions. You might incur conversion costs if you transact using other currencies.

Payment Options

This trading platform supports several payment options.

Deposits

Depositing fiat currencies to eToro is free and straightforward. Some of the available payment methods include:

- Credit/Debit cards – Visa, Mastercard, Maestro

- Bank Transfer

- Klarna/Sofort

- Neteller

- PayPal

- Skrill

Not all of these payment methods are available in all countries. You have to select a payment method that works in your country.

As earlier mentioned, you can only deposit fiat in USD. High currency conversion fees will apply if you pay using other currencies.

The minimum deposit depends on where you reside. In the U.S., the minimum deposit is $50, while in other eligible countries, the minimum is $200. Traders living in Israel have to make a minimum deposit of $10,000. Payments via bank transfer must exceed $500.

Deposits via credit cards/e-wallets are instant, but payments through banks take 4-7 days to reach your eToro account.

You can also make direct crypto deposits to your eToroX wallet from an external wallet.

Withdrawals

Traders can make fiat withdrawals through bank transfers, credit/debit cards, and e-wallets. Note that eToro charges a $5 flat-rate fee for every cash-out request.

The minimum withdrawal amount is $30.

The processing time for withdrawals depends on the payment method you pick. Here’s a look at how long each process takes.

- Bank transfer – about ten days

- Credit/Debit cards – about ten days

- E-wallets – about two days

You may experience withdrawal delays if your account isn’t fully registered.

Is eToro Safe?

eToro is regulated by several financial institutions, making it a safe trading platform. All eToro users must undergo the KYC process.

This platform stores its cryptos in cold storage, minimizing the risk of crypto losses. Only a few digital assets are in hot wallets for liquidity purposes.

Customer Support

Customer service at eToro is slightly limited. This platform does not provide support via email or phone.

You’ll find most information and answers to frequently asked questions in the Help Center. Visitors can find more help by submitting an online ticket.

Accounts below $5000 get assistance through live chat or by sending an online ticket. Ticket replies aren’t prompt and may take up to 14 days.

Accounts that exceed $5,000 have a dedicated manager, while Platinum Club level members get priority customer support.

Final Thoughts

eToro is an ideal brokerage for copy and crypto trading. It supports over 18 cryptos and offers additional asset trades like CFDs, stocks, and ETFs. The platform is easy to use, accepts many payment methods, and provides plenty of educational resources to beginner traders.