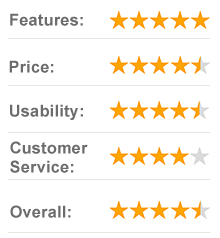

YouHodler is a lender and is most notably a cryptocurrency exchange renowned for paying good interest rates on crypto deposits. However, their services are not available in the USA, and the company should work to be more transparent about fees, risks, and rates.

Still, customers can comfortably use crypto as collateral on any short-term loans. Moreover, they can even use borrowed funds for advanced trading if they so choose.

This review will examine all aspects of operation concerning YouHodler, such as how it works, top features, the fees, the pros and cons of YouHodler’s platform, and so on. Hopefully, this thorough breakdown will help you decide if YouHodler is suitable for your individual goals and needs.

About YouHodler

Interestingly, YouHodler is a Swiss-based company that acts as a crypto-backed loan service provider. One of YouHodler’s most intriguing features is that you can still HODL (Hold On for Dear Life) without the need to wait for a spike to sell.

With this platform, you can readily borrow fiat funds instantly, based on the value of their cryptocurrency asset holdings. Furthermore, individuals can convert crypto to fiat and crypto to crypto. Users can also engage with stable coins.

Perhaps the most beneficial feature to take advantage of is the option to withdraw fiat to a personal credit card or bank account. Not only this, but users can also keep their cryptocurrency in a YouHodler savings account.

It may be easier to think of YouHodler as a virtual bank for your cryptocurrency. It is a quick and efficient option that allows individuals to transfer their crypto assets with relative ease.

How Does YouHodler Work?

YouHodler’s platform emphasizes providing a balanced experience for all users. Therefore, this platform is replete with everything an investor or crypto owner could ever need. So, this platform gives users a litany of services that allows you to manage your digital assets.

YouHodler Wallet

The inspiration behind YouHodler’s wallet is the embodiment of efficiency and simplicity. For starters, you can transfer your cryptocurrency, convert it to fiat and keep the funds in your wallet to invest. What’s more, YouHodler has specific wallet designs dedicated to Bitcoin and 14 other very popular cryptocurrencies.

Your wallet is where you will receive your earnings and manage your account. Moreover, this platform has partnered with many other institutions that’ll allow you to hold your fiat currencies securely.

Furthermore, your crypto-to-fiat wallet is a one-stop shop where you can get loans, manage your investments and open a savings account.

Getting a Loan

One of YouHodler’s major selling points is its ability to offer loans to users. Investors could look at this as an opportunity to engage in hedging. Quite generously, it provides individuals with a viable path to the cryptocurrency trading markets.

If you were to utilize the crypto-backed line of credit, you could acquire fiat when you’re in need without ever having to touch your crypto portfolio. This option removes a lot of the risk associated with investment choices.

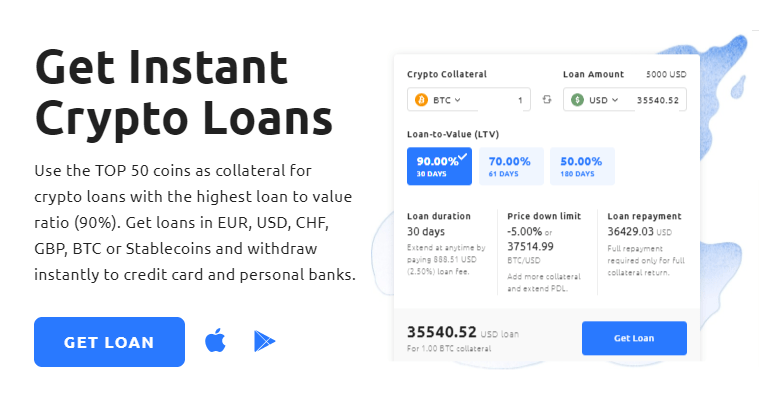

Instant Crypto Loans

YouHodler is without a doubt a leader among exchanges when it comes to instant crypto loans. They offer a top-rated loan to value ratio, which goes up to 90 percent. In addition, YouHodler outpaces its competitors significantly because they accept 15 different digital coins as collateral.

Users of YouHodler’s platform are eligible to receive crypto loans and instant cash loans in EURO, USD, CHF, GBP, and even Tether and Bitcoin. The interest rates on crypto loans are at 12 percent APR which is reasonable. If you happen to take out a short-term loan, it is possible to receive a loan with an interest rate as little as 2.5 percent.

Top Features of YouHodler

YouHodler has a lot of features that are available to make their loans more appealing to consumers. Check out the top reasons you should borrow a short-term loan from YouHodler to meet your financial needs.

Earning Interest

If you choose to hold onto your cryptocurrency coins for a long period, you should be looking for ways to earn interest on these assets. The YouHoldler platform offers up to 5 percent interest on any altcoins and 13 percent for stablecoins like the USD coin.

Your account accrues interest every week, and you get paid out in the same currency that you deposit. For example, you can’t deposit Litecoin and get interested in US dollars. You are allowed to withdraw your money at any time.

These rates are relatively solid compared to some other competitors on the market. However, that isn’t to say that you should shop around and get different options to choose from. Some companies help you earn interest if you stake your coins, meaning you tie them up to make the network more stable.

You can also accrue interest by providing liquidity, which means you commit your coins to a chosen platform so that the trading is more fluid. All options have their advantages and drawbacks, so it’s essential to analyze them based on your goals.

Borrowing Against Your Cryptocurrency

YouHodler lets their customers borrow against their crypto. So, if you find yourself in need of cash, your crypto will become collateral. As a result, this asset produces a high LTV (loan-to-value) ratio.

The ratio represents the percentage or amount of collateral at your disposal for borrowing.

Example:

If you had $500 in cryptocurrency and your loan-to-value ratio was 80 percent, you could borrow $400.

Using this method makes your loan secured, so you won’t have to go through a credit check, and you should get approved instantly. It’s always best to make sure that you’ll be able to pay the interest fees upfront so that you don’t end up losing money over the repayment period.

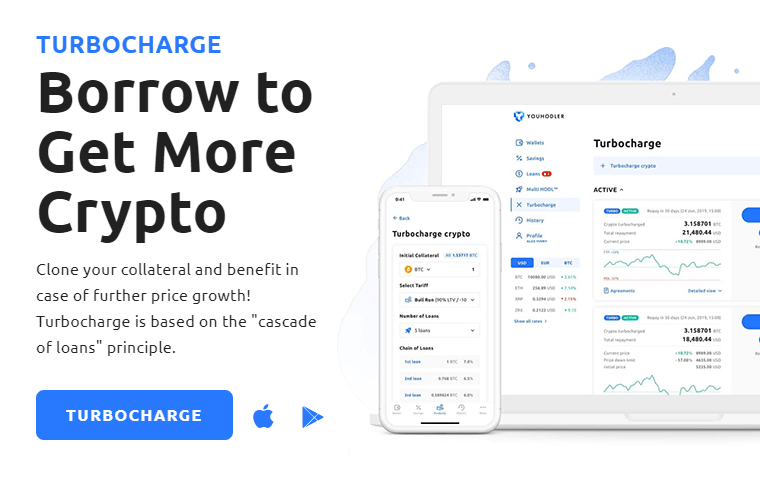

Trading Tools for Advanced Investors

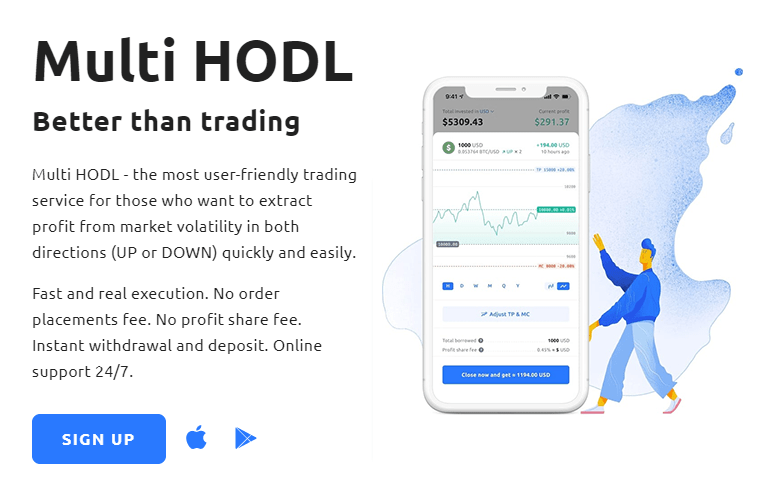

For investors who want to expand their portfolio, they have advanced tools available with YouHodler. Investors may also purchase crypto on leverage. That means you can try to predict whether the price of a cryptocoin will go up or down, also known as going long or short.

Rigid KYC (Know Your Customer) and Security Processes

This feature is either beneficial or annoying, depending on your perspective. Should you desire to remain anonymous while trading, you wouldn’t like YouHodler. However, if you appreciate the reassurance that your investment company protects its customers from money laundering, definitely give them a try.

Fees

Here are the terms and conditions for borrowing a loan or opening an account with YouHodler:

- Closing an account: 1 percent.

- Reopening an account: 1 percent service fee + an interest fee.

- Extending the PDL (Price Down Limit): 1.5 percent from the amount that you extend.

- Increase loan-to-value ratio: 1.5 percent from the amount that increased.

- Loan duration: 30/60/180 days with the choice to renew.

Liquidation occurs to your loan collateral when the price of said collateral is at ⅔ of the PDL.

You will receive an email notification before this happens if your collateral drops below ⅔ of the PDL.

At that time, you may choose to add more collateral or sell. In the instance that you don’t add more collateral, and the price reaches ⅔, YouHodler reserves the right to liquidate or sell. They sell on the open market so that they are guaranteed to have the loan repaid to them.

Summary of Pros and Cons

Here are the key takeaways of what YouHodler has to offer and where they can improve:

Pros

- They have strong security features.

- Your cryptocurrency assets receive insurance of up to 150 million dollars.

- YouHodler has some of the most attractive interest rates on stablecoins.

- They have a variety of unique tools and features like Turbocharge and MultiHODL.

- The terms for loans are flexible; you have the option to increase your loan term at any time.

- They have a high loan-to-value ratio; the top coins in the market can get used as your loan collateral, with the LTV sitting at 90 percent.

Cons

- The company was recently founded in 2018.

- Based on which collaterals you utilize for collateral, you might only be able to get loans in EUR, USD, BTC, and GBP.

Final Thoughts

If you’re an investor, a crypto loan is a great tool that you can use to leverage assets or for hedging. YouHodler has enticing rates and flexibility that makes it a tough competitor in the field.

This platform is best for those who have a large amount of crypto stored up that they aren’t using at the moment. Who doesn’t want a chance to earn interest on the money you have no immediate plans for?

If you find that you need to borrow money, YouHodler is an excellent solution for short-term financial needs. With enhanced security features and a reliable customer service team, YouHodler just may be your best bet for a crypto loan company.